2024 Cooling Measures: A Genuine Solution or Just Another Band-Aid for HDB Affordability?

In the dynamic landscape of Singapore’s real estate market, the 2024 property cooling measures have garnered significant attention. With a focus on keeping HDB resale flats affordable, the government has introduced new restrictions and incentives aimed at first-time buyers and private property owners. But will these measures truly achieve their intended goals? Let’s delve into the changes, their implications, and whether they are likely to succeed in making HDB flats more accessible.

Key Measures and Their Impact

1. Lower Loan-to-Value (LTV) Limit: The reduction in the LTV limit means that first-time buyers can now borrow a smaller percentage of the property’s value. While this aims to encourage more prudent borrowing and reduce the risk of over-leveraging, it also means that buyers will need to have more cash on hand or larger CPF savings to fund their purchase. This could potentially limit the purchasing power of first-time buyers, making it more challenging to enter the market.

2. Increased CPF Housing Grants: On the flip side, the government has increased CPF housing grants for first-time buyers. This is designed to offset the impact of the reduced LTV limit, providing additional financial support to help bridge the gap. However, the effectiveness of this measure depends on whether the increased grants are sufficient to cover the difference caused by the lower borrowing limit.

3. 15-Month Wait-Out Period for Private Property Owners: The introduction of a 15-month wait-out period for private property owners looking to purchase a resale HDB flat is a significant move. This measure is intended to curb demand from wealthier buyers who might otherwise drive up resale prices. While this could help keep prices in check, it also reduces the pool of potential buyers for HDB resale flats, which might slow down the market.

Insights: The Unspoken Realities

While the measures are well-intentioned, their actual impact on affordability remains uncertain. Historically, cooling measures have had mixed results. For instance, while they can temper demand in the short term, they often lead to pent-up demand that eventually drives prices back up once the restrictions are lifted.

Moreover, the timing of these measures is crucial. Singapore’s property market has been resilient, with HDB resale prices rising for 17 consecutive quarters as of Q2 2024. The introduction of these measures at a time when the market is already heated could slow down the pace of price increases, but it is unlikely to cause a significant drop in prices.

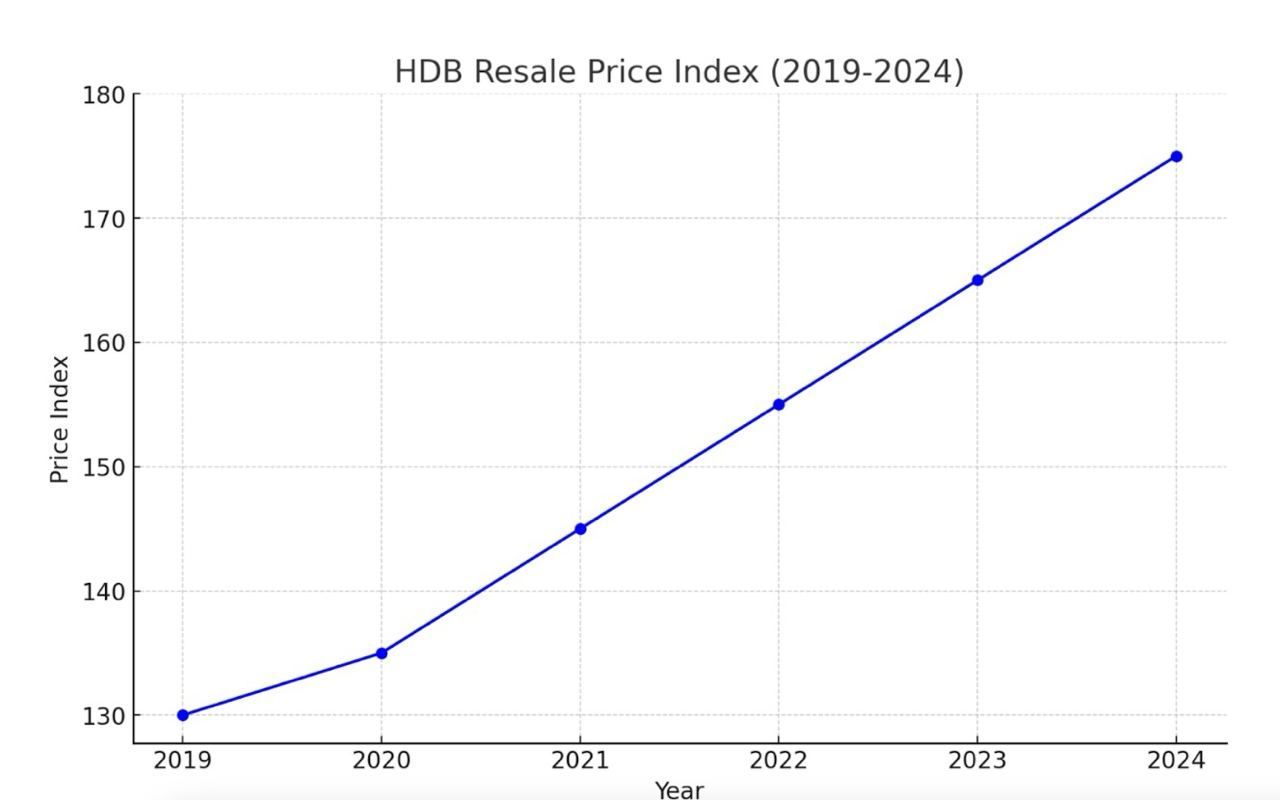

Graph 1: HDB Resale Price Index (2019-2024) Data Source: Housing Development Board (HDB)

This graph illustrates the steady rise in HDB resale prices over the past five years. Even with previous cooling measures in place, prices have continued to climb, reflecting the strong demand and limited supply in the market.

Timing and Market Resilience:

The introduction of the latest cooling measures comes at a time when Singapore’s property market is experiencing sustained growth, with HDB resale prices having risen for 17 consecutive quarters. This prolonged period of price appreciation indicates strong underlying demand, driven by various factors including population growth, limited land availability, and a general perception of property as a safe and lucrative investment.

Why These Measures May Slow but Not Stop Growth:

The intent behind these measures is clear: to make HDB flats more affordable for Singaporeans, particularly first-time buyers. However, the success of this initiative hinges on several factors:

1. Market Sentiment and Investor Behaviour:

- The Singaporean property market is heavily influenced by sentiment, particularly among investors who view property as a stable asset class. Even with stricter loan-to-value limits and other cooling measures, the fundamental belief in the long-term value of property remains strong. Investors might adopt a wait-and-see approach, holding off on purchases in the short term, but this can create a backlog of demand that could drive prices up again once market conditions are perceived as more favourable.

2. Structural Factors Limiting Supply:

Singapore’s limited land availability and the government’s careful management of land supply mean that the overall availability of new housing remains restricted. Even with cooling measures in place, this structural limitation ensures that demand will continue to outstrip supply in the long term, supporting price stability or even further increases.

3. Affordability vs. Aspirational Ownership:

- While the measures are aimed at keeping flats affordable, there’s a cultural aspiration in Singapore to own property as a sign of success and stability. This aspirational ownership drives demand, particularly in a society where home ownership is closely tied to personal and financial security. The cooling measures may reduce speculative buying, but they are less likely to deter genuine homebuyers, especially first-timers who may still perceive the current market conditions as a good time to enter before prices climb further.

4. Economic and Demographic Trends:

- Singapore’s robust economy, coupled with its status as a global financial hub, continues to attract both local and international buyers. Additionally, ongoing urbanisation and the government’s plans to redevelop and rejuvenate certain areas (such as the Greater Southern Waterfront) contribute to a positive long-term outlook for property values. These factors create a strong demand base that is likely to persist, regardless of temporary cooling measures.

5. Interest Rates and Global Economic Conditions:

- The current global economic environment, particularly the interest rate landscape, also plays a role. While interest rates have been rising, they remain relatively low by historical standards, making borrowing still relatively affordable. This, combined with a stable employment market in Singapore, means that buyers may still be willing to take on property purchases despite the cooling measures. The cooling measures may slow the rate of price increases, but they are unlikely to cause a significant drop unless there is a major shift in these broader economic conditions.

The cooling measures introduced are a necessary tool to prevent runaway property prices, but their impact is likely to be moderate. They may succeed in slowing the pace of price increases temporarily, but given Singapore’s market dynamics, structural supply limitations, and cultural factors, a significant drop in prices seems unlikely. Instead, we might see a period of stabilisation, followed by renewed growth once the effects of the cooling measures dissipate. For buyers and investors, this could mean that the best strategy is to remain vigilant and responsive to market changes, rather than waiting for a dramatic correction that may never materialise.

Temporary Relief and the Pent-Up Demand Phenomenon

The cyclical nature of cooling measures in Singapore’s property market is a fascinating phenomenon that sheds light on the complexities of managing real estate prices in a tightly regulated environment. Here’s an expanded exploration of why cooling measures often result in only temporary effects and how they might lead to a rebound in prices.

1. Initial Impact of Cooling Measures:

- When cooling measures are first introduced, they often have an immediate impact on the market. This usually manifests as a slowdown in transaction volumes, as buyers and investors pause to reassess the market. The intention behind these measures is to curb speculative buying, reduce the risk of a property bubble, and stabilise prices. In the short term, these goals are often achieved as buyers adopt a wait-and-see approach, leading to a cooling of market activity.

2. Market Adjustment and Buyer Adaptation:

- Over time, however, the market begins to adjust. Buyers, particularly those with genuine housing needs or long-term investment strategies, start to adapt to the new regulations. This could involve saving for larger down payments due to lower loan-to-value limits, or shifting their focus to more affordable property segments. As buyers adapt, the initial dampening effect of the cooling measures starts to wane, and transaction volumes may begin to pick up again.

3. The Build-Up of Pent-Up Demand:

- As the market adjusts, pent-up demand starts to build. This occurs because potential buyers who were initially deterred by the cooling measures do not exit the market altogether; instead, they delay their purchases. Over time, as these buyers accumulate more savings, or as market conditions become more favourable (e.g., a slight dip in prices or a stabilisation of interest rates), they re-enter the market en masse. This surge in demand can create a new wave of transactions, leading to a rebound in prices.

The Cyclical Nature of Cooling Measures

1. The Repeat Cycle:

- Historically, Singapore has seen multiple rounds of cooling measures, each followed by a period of market adjustment and subsequent price recovery. For example, significant cooling measures were introduced in 2013, which temporarily slowed the market. However, by 2017, property prices began to rise again, prompting another round of cooling measures in 2018. This cycle of intervention, adjustment, and rebound highlights the challenge of achieving long-term price stability in a dynamic and resilient market.

2. Psychological Impact on Buyers and Sellers:

- Another aspect of this cycle is the psychological impact on market participants. Buyers and sellers, particularly those who have experienced previous cycles, may come to expect that prices will eventually rebound after each round of cooling measures. This expectation can lead to strategic behaviour, such as holding off on sales until after the market recovers or timing purchases to coincide with the expected bottom of the market. This behaviour further reinforces the cyclical nature of the market.

3. Supply-Side Constraints:

- The cyclical effects of cooling measures are also exacerbated by supply-side constraints. In a land-scarce country like Singapore, the supply of new housing is tightly controlled by the government. This means that even when demand is temporarily tempered by cooling measures, the limited supply can continue to exert upward pressure on prices once the demand returns. This is particularly true in desirable locations, where the scarcity of land makes price corrections less likely to be sustained.

The Long-Term Outlook

Given this cyclical pattern, the long-term outlook for Singapore’s property market suggests that while cooling measures can provide short-term relief, they are unlikely to result in sustained price drops. Instead, they may create windows of opportunity for buyers who can act strategically, as well as challenges for those who are less able to navigate the timing of their purchases. For policymakers, the challenge lies in balancing the need to prevent excessive price inflation with the understanding that long-term market dynamics are difficult to control through regulatory measures alone.

The Strategic Implications for Buyers and Investors

For buyers and investors, understanding the cyclical nature of cooling measures is crucial. Rather than waiting for a significant and sustained drop in prices, which history suggests is unlikely, the focus should be on timing market entry to align with periods of lower demand and better affordability. Additionally, recognising the potential for price rebounds can inform decisions about when to sell or hold onto property investments.

This cyclical understanding also highlights the importance of working with experienced professionals who can provide insights into market trends and help navigate the complexities of the real estate market. With over 30 years of experience, experts like Mike Parikh can offer the strategic guidance needed to make informed decisions, whether you are buying, selling, or investing in Singapore’s property market.

So, How Should Buyers and Sellers Respond?

For buyers, particularly first-time buyers, it is essential to assess your financial situation carefully. While the increased CPF grants are helpful, the reduced LTV limit means that you may need more cash upfront. Consider whether now is the right time to buy or if it might be worth waiting to see how the market adjusts to these new measures.

For sellers, especially those with properties in non-prime locations, the reduced pool of buyers due to the 15-month wait-out period might mean that it takes longer to sell your flat. However, with prices still at historically high levels, selling now could maximise your returns before any potential market slowdown.

Conclusion: Will These Measures Work?

The 2024 cooling measures are a strategic attempt by the government to balance affordability with market stability. While they may slow the pace of price increases, it is unlikely that they will lead to a significant drop in HDB resale prices. The continued demand for housing in Singapore, coupled with supply constraints, suggests that prices will remain strong.

For those navigating this complex market, whether buying or selling, the guidance of an experienced real estate professional is invaluable. With over 30 years in the industry, Mike Parikh offers unparalleled insights and strategic advice to help you make informed decisions.

For more information and to explore your options, visit Mike Parikh's website or call Mike at 93838818 today.